The Content covered in this article:

बीमा पॉलिसी विधि (Insurance Policy Method):

बीमा पॉलिसी पद्धति (Insurance Policy Method) में, एक एंडोमेंट पॉलिसी एक बीमा कंपनी से एक राशि(amount) के लिए ली जाती है जो किसी संपत्ति के प्रतिस्थापन के लिए पर्याप्त होती है। यह डूबती निधि पद्धति के समान है केवल अंतर यह है कि हम निवेश के बजाय बीमा पॉलिसी लेते हैं। बीमा पॉलिसी शब्द किसी संपत्ति के जीवन के बराबर होगा।

बीमा पॉलिसी विधि (Insurance Policy Method) के लिए जर्नल प्रविष्टियाँ:

1st Year:

वर्ष के अंत में खरीदी गई और शेष बची हुई दो प्रविष्टियाँ निम्नलिखित पोस्ट की जाएंगी

1) Asset A/c Dr ________

To Bank A/c ________

(Being asset purchased )

2) Depreciation Insurance Policy A/c A/c Dr. ________

To Bank A/c ________

(Being Premium of an Insurance policy paid)

* (ज्यादातर मामलों में, बीमा पॉलिसी एक परिसंपत्ति की खरीद के एक ही समय में खरीदी जाएगी क्योंकि तब हमें परिसंपत्ति को बदलने के लिए आवश्यक राशि की अधिकतम राशि प्राप्त होगी)

3) Depreciation A/c Dr ________

To Depreciation Fund A/c ________

(Being dep. charged for the year)

4) Profit/loss A/c Dr. ________

To Depreciation A/c ________

(Being dep. of the year transferred to P/L A/c)

5) Depreciation Insurance Policy A/c A/c Dr. ________

To Depreciation Fund A/c ________

(Being increase in the balance of policy – If any)

Subsequent Years: –

1) Depreciation Insurance Policy A/c A/c Dr. ________

To Bank A/c ________

(Being Premium of an Insurance policy paid)

2) Depreciation A/c Dr ________

To Depreciation Fund A/c ________

(Being dep. charged for the year)

3) Profit/loss A/c Dr. ________

To Depreciation A/c ________

(Being dep. of the year transferred to P/L A/c)

4) Depreciation Insurance Policy A/c A/c Dr. ________

To Depreciation Fund A/c ________

(Being increase in the balance of policy – If any)

In the Last Year: –

1) Depreciation Insurance Policy A/c A/c Dr. ________

To Bank A/c ________

(Being Premium of an Insurance policy paid)

2) Depreciation A/c Dr ________

To Depreciation Fund A/c ________

(Being dep. charged for the year)

3) Profit/loss A/c Dr. ________

To Depreciation A/c ________

(Being dep. of the year transferred to P/L A/c)

4) Depreciation Insurance Policy A/c A/c Dr. ________

To Depreciation Fund A/c ________

(Being increase in the balance of policy – If any)

5) Bank A/c Dr. ________

To Depreciation Insurance Policy a/c ________

(Being received the amount of insurance policy on maturity – At par)

or

5) Bank A/c Dr. ________

Depreciation Fund A/c Dr. ________

To Depreciation Insurance Policy a/c ________

(Being received the amount of insurance policy on maturity – At loss)

or

5) Bank A/c Dr. ________

To Depreciation Insurance Policy a/c ________

To Depreciation Fund A/c ________

(Being received the amount of insurance policy on maturity – At Profit)

मूल्यह्रास की बीमा पॉलिसी विधि (Insurance Policy Method) का उदाहरण:

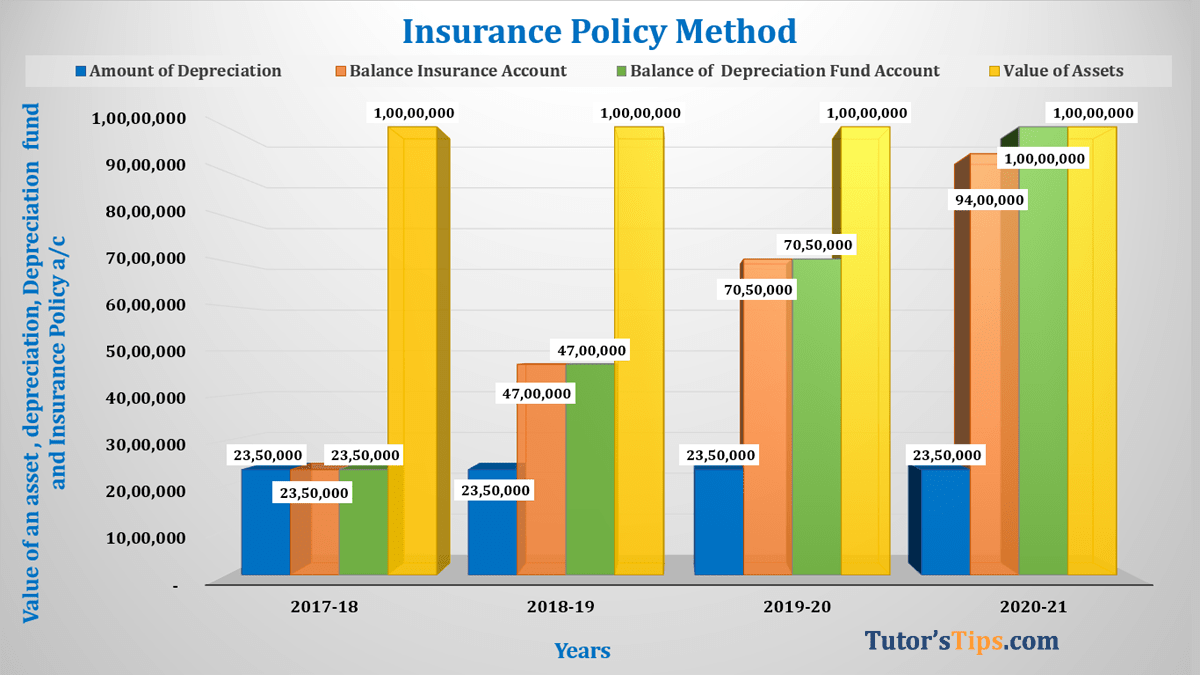

On 1st April 2017, A lease of land is purchased for four years for Rs. 1,00,00,000/- and it is decided to make provision for the replacement of the lease by means of an insurance policy purchased for an annual premium of Rs. 23,00,000/- with the amount of sum assured Rs 1,00,00,000/- on the maturity date 31/03/2021.

उपाय (Solution) : –

हम वर्ष दर वर्ष सभी जर्नल प्रविष्टियाँ पोस्ट करेंगे जो कि बीमा पॉलिसी विधि मूल्यह्रास के अनुसार निम्नलिखित है: –

| Date | Particulars | L.F. | Debit | Credit | ||

| 2017-18 | ||||||

| 01-Apr | Lease (Land) A/c | Dr. | 1,00,00,000 | |||

| To Bank A/c | 1,00,00,000 | |||||

| (Being land purchased on lease ) | ||||||

| 31-Mar | Depreciation Insurance Policy A/c | Dr. | 23,50,000 | |||

| To Bank A/c | 23,50,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Depreciation A/c | Dr. | 23,50,000 | |||

| To Depreciation Fund A/c | 23,50,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Profit or loss A/c | Dr. | 23,50,000 | |||

| To Depreciation A/c | 23,50,000 | |||||

| (Being Depreciation transfer to P&L A/c) | ||||||

| 2018-19 | ||||||

| 31-Mar | Depreciation Insurance Policy A/c | Dr. | 23,50,000 | |||

| To Bank A/c | 23,50,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Depreciation A/c | Dr. | 23,50,000 | |||

| To Depreciation Fund A/c | 23,50,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Profit or loss A/c | Dr. | 23,50,000 | |||

| To Depreciation A/c | 23,50,000 | |||||

| (Being Depreciation transfer to P&L A/c) | ||||||

| 2019-20 | ||||||

| 31-Mar | Depreciation Insurance Policy A/c | Dr. | 23,50,000 | |||

| To Bank A/c | 23,50,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Depreciation A/c | Dr. | 23,50,000 | |||

| To Depreciation Fund A/c | 23,50,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Profit or loss A/c | Dr. | 23,50,000 | |||

| To Depreciation A/c | 23,50,000 | |||||

| (Being Depreciation transfer to P&L A/c) | ||||||

| 2020-21 | ||||||

| 31-Mar | Depreciation Insurance Policy A/c | Dr. | 23,50,000 | |||

| To Bank A/c | 23,50,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Depreciation A/c | Dr. | 23,50,000 | |||

| To Depreciation Fund A/c | 23,50,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Profit or loss A/c | Dr. | 23,50,000 | |||

| To Depreciation A/c | 23,50,000 | |||||

| (Being Depreciation transfer to P&L A/c) | ||||||

| 31-Mar | Bank A/c | Dr. | 1,00,00,000 | |||

| To Depreciation Insurance Policy A/c | 94,00,000 | |||||

| TO Depreciation Fund A/c | 6,00,000 | |||||

| (Being on maturity we received an amount of sum assured of an insurance policy) | ||||||

| 31-Mar | Depreciation Fund A/c | Dr. | 1,00,00,000 | |||

| To Lease (Land) A/c | 1,00,00,000 | |||||

| (Being Balance of Depreciation fund account transferred to Lease account) | ||||||

अब, हम इन सभी लेनदेन को बीमा पॉलिसी विधि (Insurance Policy Method) मूल्यह्रास के अनुसार खाता बही में पोस्ट करेंगे: –

| Lease (Land) Account | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| 01-04-17 | To Bank A/c | 1,00,00,000 | |||

| 31-03-18 | By Balance C/d | 1,00,00,000 | |||

| 1,00,00,000 | 1,00,00,000 | ||||

| 01-04-18 | To Balance B/d | 1,00,00,000 | |||

| 31-03-19 | By Balance C/d | 1,00,00,000 | |||

| 1,00,00,000 | 1,00,00,000 | ||||

| 01-04-19 | To Balance B/d | 1,00,00,000 | |||

| 31-03-20 | By Balance C/d | 1,00,00,000 | |||

| 1,00,00,000 | 1,00,00,000 | ||||

| 01-04-20 | To Balance B/d | 1,00,00,000 | 31-03-21 | By Depreciation Fund A/c | 1,00,00,000 |

| 31-03-21 | By Balance C/d | – | |||

| 1,00,00,000 | 1,00,00,000 | ||||

| Depreciation Fund Account | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| 31-03-18 | By Depreciation A/c | 23,50,000 | |||

| 31-03-18 | To Balance C/d | 23,50,000 | |||

| 23,50,000 | 23,50,000 | ||||

| – | 31-03-19 | By Balance B/d | 23,50,000 | ||

| 31-03-19 | To Balance C/d | 47,00,000 | 31-03-19 | By Depreciation A/c | 23,50,000 |

| 47,00,000 | 47,00,000 | ||||

| – | 31-03-20 | By Balance B/d | 47,00,000 | ||

| 31-03-20 | To Balance C/d | 70,50,000 | 31-03-20 | By Depreciation A/c | 23,50,000 |

| 70,50,000 | 70,50,000 | ||||

| 31-03-21 | To Lease(Land) A/c | 10,00,000 | 31-03-21 | By Balance B/d | 70,50,000 |

| – | 31-03-21 | By Depreciation A/c | 23,50,000 | ||

| 31-03-21 | To Balance C/d | – | 31-03-21 | By Bank A/c (Profit) | 6,00,000 |

| 1,00,00,000 | 1,00,00,000 | ||||

| Depreciation Account | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| 31-03-18 | To Profit/Loss A/c | 23,50,000 | 31-03-18 | By Depreciation A/c | 23,50,000 |

| 23,50,000 | 23,50,000 | ||||

| 31-03-19 | To Profit/Loss A/c | 23,50,000 | 31-03-19 | By Depreciation A/c | 23,50,000 |

| 23,50,000 | 23,50,000 | ||||

| 31-03-20 | To Profit/Loss A/c | 23,50,000 | 31-03-20 | By Depreciation A/c | 23,50,000 |

| 23,50,000 | 23,50,000 | ||||

| 31-03-21 | To Profit/Loss A/c | 23,50,000 | 31-03-21 | By Depreciation A/c | 23,50,000 |

| 23,50,000 | 23,50,000 | ||||

| Insurance Policy Account | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| 01-04-17 | To Bank A/c | 23,50,000 | |||

| 01-04-18 | By Balance C/d | 23,50,000 | |||

| 23,50,000 | 23,50,000 | ||||

| 01-04-18 | To Balance B/d | 23,50,000 | |||

| 01-04-18 | To Bank A/c | 23,50,000 | 01-04-19 | By Balance C/d | 47,00,000 |

| 47,00,000 | 47,00,000 | ||||

| 02-04-19 | To Balance B/d | 47,00,000 | |||

| 02-04-19 | To Bank A/c | 23,50,000 | 01-04-20 | By Balance C/d | 70,50,000 |

| 70,50,000 | 70,50,000 | ||||

| 01-04-20 | To Balance B/d | 70,50,000 | 01-04-21 | By Bank A/c | 94,00,000 |

| 01-04-20 | To Bank A/c | 23,50,000 | 01-04-21 | By Balance C/d | – |

| 94,00,000 | 94,00,000 | ||||

यदि आपने इन निम्नलिखित विषयों को नहीं पढ़ा है, तो कृपया लिंक पर क्लिक करें और इन्हें देखें।

मूल्यह्रास की बीमा पॉलिसी विधि (Insurance Policy Method) के विषय को पढ़ने के लिए धन्यवाद, कृपया अपनी प्रतिक्रिया टिप्पणी करें।

या

अगर आपका कोई सवाल है तो हमें कमेंट करके पूछें

कृपया शेयर करें और इसे फैलाएं

Check out Financial Accounting Books @ Amazon.in