The Content covered in this article:

ह्रासमान संतुलन विधि (Diminishing Balance Method of Depreciation): –

ह्रासमान संतुलन विधि (Diminishing Balance Method) में, हमने किसी परिसंपत्ति और मूल्य के समापन मूल्य पर मूल्यह्रास की गणना की है जब तक कि किसी परिसंपत्ति का पुस्तक मूल्य इसके स्क्रैप मूल्य के बराबर नहीं होगा। मूल्यह्रास (Depreciation) की राशि पिछले वर्ष की तुलना में कम या कम हो जाएगी क्योंकि हम किसी परिसंपत्ति के समापन मूल्य पर मूल्यह्रास की निर्धारित दर का शुल्क लेते हैं।

इसे लिखित मूल्य और मूल्य घटाने की विधि भी कहा जाता है।

यह विधि मूर्त संपत्ति जैसे भवन, संयंत्र और मशीनरी और फर्नीचर और स्थिरता, आदि के लिए उपयुक्त है।

इस विधि के तहत मूल्यह्रास की गणना निम्न सूत्र की सहायता से की जा सकती है:

उदाहरण (Example explaining Diminishing Balance Method)

On 01/04/2017 Machinery purchased for Rs 11,00,000/- and paid for transportation charge 1,50,000/- to install the machine in our plant and paid installation charges also for Rs 50,000/-. The rate of Depreciation @ 10% Year ending 31 March.

So, Total Cost of an asset = 11,00,000+1,50,000+50,000

Advertisement

= Rs 13,00,000/-

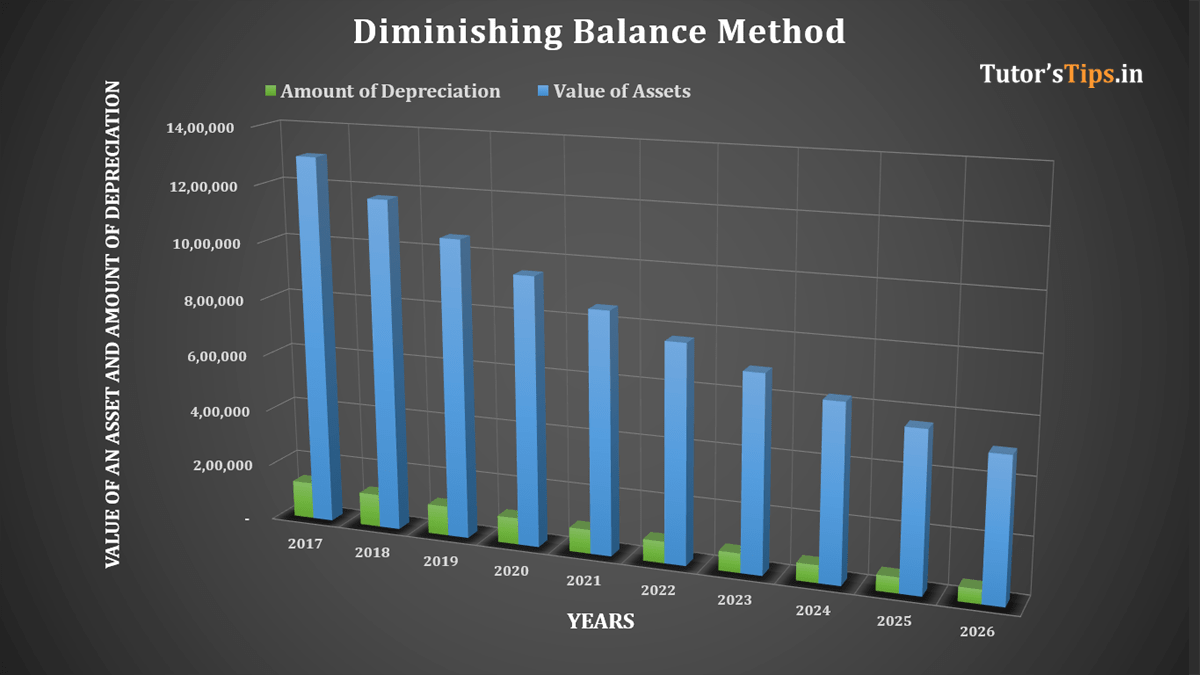

निम्न तालिका वर्ष के मूल्यह्रास को कम करके शेष राशि दर्शाती है.

| Year ended | Opening balance of an asset | Amount of depreciation | The closing balance of an asset |

| 31-03-2017 | 13,00,000 | 1,30,000 | 11,70,000 |

| 31-03-2018 | 11,70,000 | 1,17,000 | 10,53,000 |

| 31-03-2019 | 10,53,000 | 1,05,300 | 9,47,700 |

| 31-03-2020 | 9,47,700 | 94,770 | 8,52,930 |

| 31-03-2021 | 8,52,930 | 85,293 | 7,67,637 |

| 31-03-2022 | 7,67,637 | 76,764 | 6,90,873 |

| 31-03-2023 | 6,90,873 | 69,087 | 6,21,786 |

| 31-03-2024 | 6,21,786 | 62,179 | 5,59,607 |

| 31-03-2025 | 5,59,607 | 55,961 | 5,03,647 |

| 31-03-2026 | 5,03,647 | 50,365 | 4,53,282 |

| 31-03-2027 | 4,53,282 | 45,328 | 4,07,954 |

| 31-03-2028 | 4,07,954 | 40,795 | 3,67,158 |

| 31-03-2029 | 3,67,158 | 36,716 | 3,30,443 |

| 31-03-2030 | 3,30,443 | 33,044 | 2,97,398 |

| 31-03-2031 | 2,97,398 | 29,740 | 2,67,658 |

| 31-03-2032 | 2,67,658 | 26,766 | 2,40,893 |

| 31-03-2033 | 2,40,893 | 24,089 | 2,16,803 |

| 31-03-2034 | 2,16,803 | 21,680 | 1,95,123 |

| 31-03-2035 | 1,95,123 | 19,512 | 1,75,611 |

| 31-03-2036 | 1,75,611 | 17,561 | 1,58,050 |

| 31-03-2037 | 1,58,050 | 15,805 | 1,42,245 |

| 31-03-2038 | 1,42,245 | 14,224 | 1,28,020 |

| 31-03-2039 | 1,28,020 | 12,802 | 1,15,218 |

| 31-03-2040 | 1,15,218 | 11,522 | 1,03,696 |

| 31-03-2041 | 1,03,696 | 10,370 | 93,327 |

अब, हम वर्ष दर वर्ष सभी जर्नल प्रविष्टियाँ इस प्रकार पोस्ट करेंगे: –

| Date | Particulars | L.F. | Debit | Credit | ||

| 1st Year | ||||||

| 2016-17 | ||||||

| 01-Apr | Machinery A/c | Dr. | 13,00,000 | |||

| To Bank A/c | 13,00,000 | |||||

| (Being land purchased on lease ) | ||||||

| 31-Mar | Depreciation A/c | Dr. | 1,30,000 | |||

| To Machinery A/c | 1,30,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Profit or loss A/c | Dr. | 1,30,000 | |||

| To Depreciation A/c | 1,30,000 | |||||

| (Being Depreciation transfer to P&L A/c) | ||||||

| 2nd Year | ||||||

| 2017-18 | ||||||

| 31-Mar | Depreciation A/c | Dr. | 1,17,000 | |||

| To Machinery A/c | 1,17,000 | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Profit or loss A/c | Dr. | 1,17,000 | |||

| To Depreciation A/c | 1,17,000 | |||||

| (Being Depreciation transfer to P&L A/c) | ||||||

| Subsequent Years | ||||||

| 2017-18 | ||||||

| 31-Mar | Depreciation A/c | Dr. | _______ | |||

| To Machinery A/c | _______ | |||||

| (Being Depreciation on asset charged) | ||||||

| 31-Mar | Profit or loss A/c | Dr. | _______ | |||

| To Depreciation A/c | _______ | |||||

| (Being Depreciation transfer to P&L A/c) | ||||||

| Note: – | Journal Entries will be the same for all subsequent years but the only amount of depreciation will be changed as calculated in the above table | |||||

| Machinery Account | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| 01-04-2017 | To Bank A/c | 11,00,000 | 31-03-2018 | By Depreciation A/c | 1,30,000 |

| 01-04-2017 | To Bank A/c | 1,50,000 | 31-03-2018 | By Balance C/d | 11,70,000 |

| (Transportation) | (Balancing Fig) | ||||

| 01-04-2017 | To Bank A/c | 50,000 | |||

| (Installation) | |||||

| 13,00,000 | 13,00,000 | ||||

| 01-04-2018 | To Balance B/d | 11,70,000 | 31-03-2019 | By Depreciation A/c | 1,17,000 |

| 31-03-2019 | By Balance C/d | 10,53,000 | |||

| (Balancing Fig) | |||||

| 11,70,000 | 11,70,000 | ||||

| 01-04-2019 | To Balance B/d | 10,53,000 | 31-03-2020 | By Depreciation A/c | 1,05,300 |

| 31-03-2020 | By Balance C/d | 9,47,700 | |||

| (Balancing Fig) | |||||

| 10,53,000 | 10,53,000 | ||||

| 01-04-2020 | To Balance B/d | 9,47,700 | 31-03-2021 | By Depreciation A/c | 94,770 |

| 31-03-2021 | By Balance C/d | 8,52,930 | |||

| (Balancing Fig) | |||||

| 9,47,700 | 9,47,700 | ||||

| 01-04-2020 | To Balance B/d | 8,52,930 | 31-03-2021 | By Depreciation A/c | 85,293 |

| 31-03-2021 | By Balance C/d | 7,67,637 | |||

| (Balancing Fig) | |||||

| 8,52,930 | 8,52,930 | ||||

| same entries will be posted till the value of the asset become zero or equal to scrap value | |||||

यदि आपके पास ह्रासमान संतुलन विधि (Diminishing balanced method) के इस विषय के बारे में कोई प्रश्न हैं, तो कृपया नीचे टिप्पणी अनुभाग में पूछें।

धन्यवाद,

Check out Financial Accounting Books @ Amazon.in